A few thoughts for your consideration:

the devil is in the detail of the policy. Read not only the coverage but the defined terms and exclusion clauses under each rider for a clear understanding of what is covered and what is not,

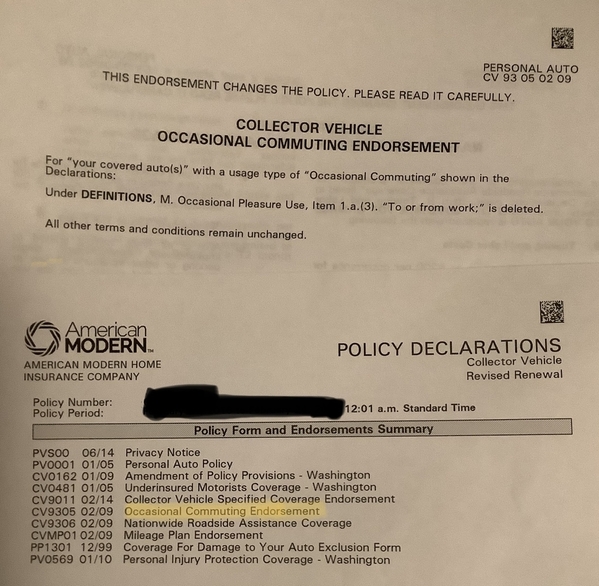

My experience since 2013: only American Modern was willing to provide me a specific “commuter rider” in writing, in addition to a modification of the definition for “pleasure use” to delete commuting from the exclusion of coverage articles. Occasional Pleasure Use and Commuting are defined terms in most policies, and exclude things like picking up your kids from school, running to the grocery store, in addition to commuting to/from work. basically daily life driving is excluded from most policies.

My specific commuter rider allows me to commute two days per week (on a 52 week calendar year policy)… not to exceed 102 consecutive days per calendar year. Basically nearly every day during the warm driving season. I start counting in April, and typically hit 102 days by late September (rainy season in the PNW).

Neither Grundy nor Hagerty have been willing to put this level of clarity in writing in their policy, I ask every year and provide them a sample of what revisions I’m looking for at renewal time ( I like to shop things out before renewing every year).

My cost per year is ~500$ on a 45k agreed value and 6000 mileage yearly cap.

IMHO, whatever it is you want coverage for make sure to get it in writing. Happy to message you more details if you need them,